Découvrez comment l’intelligence artificielle réinvente chaque aspect de votre entreprise, de l’amélioration du service client à la gestion des tâches routinières. Cet article explore les façons dont l’IA booste la productivité, optimise les processus et enrichit l’expérience client.

Êtes-vous prêts à transformer votre activité en combinant la technologie avec le savoir-faire humaine ? Cap sur différentes façons d’utiliser l’IA dans votre quotidien professionnel.

Utiliser l’IA pour la rédaction de texte

L’assistance par IA transforme radicalement la rédaction de contenu. Des outils intelligents comme ChatGPT-4, Jasper et Writesonic utilisent des modèles de langage avancés pour produire des textes cohérents et élégamment formulés.

Les atouts de la rédaction avec l’IA ?

- Un gain de temps dans les recherches pré-rédaction

- Une accélération notable du processus rédactionnel

- Une génération d’idées innovantes (efficace pour lutter contre la page blanche)

- Une aide pour l’optimisation SEO

- La conformité stylistique sur des contenus volumineux ou de multiples textes

Toutefois, utiliser l’IA nécessite une approche réfléchie. Malgré ces avancées, les chatbots restent des assistants qui vont dégrossir le travail et vous fournir un brouillon exploitable. Il sera toujours nécessaire de repasser derrière l’intelligence artificielle pour personnaliser et humaniser le contenu.

Vos articles de blog, e-mails, newsletters, publications sur les réseaux sociaux, pages de site web ou livres blancs doivent refléter authentiquement votre marque. Une finesse que l’IA ne saisit pas encore parfaitement.

Pour une personnalisation et une optimisation optimale de vos contenus, vous pouvez également faire appel à un rédacteur web freelance sur Codeur.com !

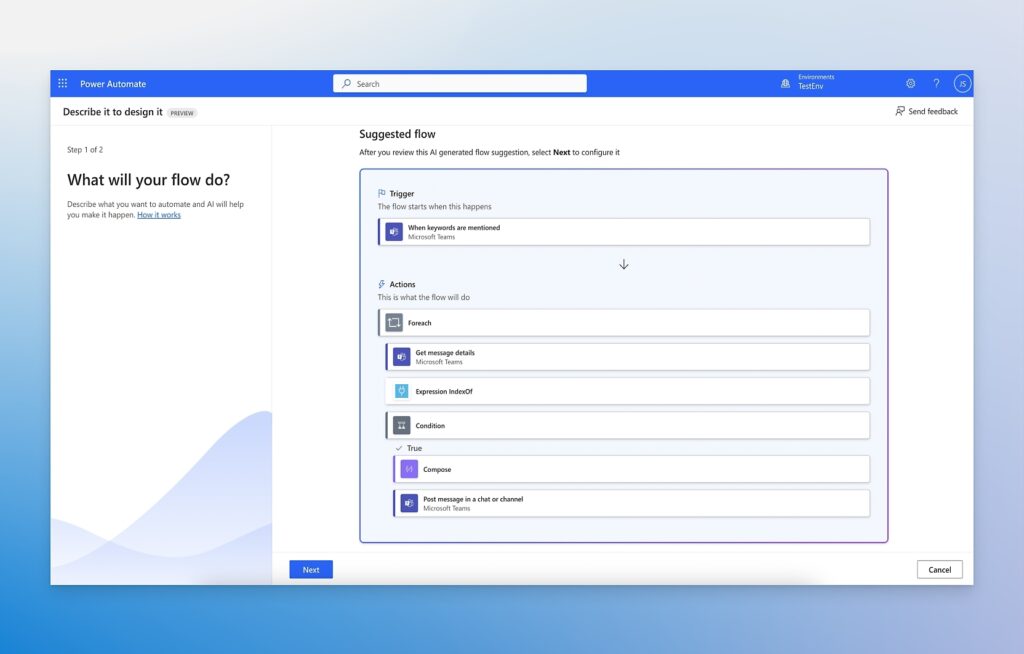

Création de petits scripts pour automatiser des tâches

Des plateformes telles que UiPath, Automation Anywhere ou Microsoft Power Automate permettent de développer des scripts qui automatisent l’extraction de données et la conversion de formats de fichiers. Et ce n’est pas tout ! Ces intelligences artificielles apprennent aussi à optimiser leurs processus au fil du temps. Grâce à elles, vous consacrez moins de temps à des tâches fastidieuses et vous réduisez significativement les risques d’erreur.

Néanmoins, il est indispensable de garder une main sur le volant ! Ce type d’automatisation nécessite une surveillance régulière pour s’assurer que les scripts restent à jour, fonctionnels et adaptés aux besoins de l’entreprise.

Par exemple, un script conçu pour extraire des données de facturation à partir d’un format de fichier spécifique peut devenir obsolète si le format des documents sources est modifié ou si la réglementation relative à la gestion des données évolue (ce qui sera le cas avec la loi sur la facturation électronique !).

Si vous avez du mal à réaliser vos automatisations avec ChatGPT, faites appel à un développeur freelance sur Codeur.com pour créer des scripts rapidement.

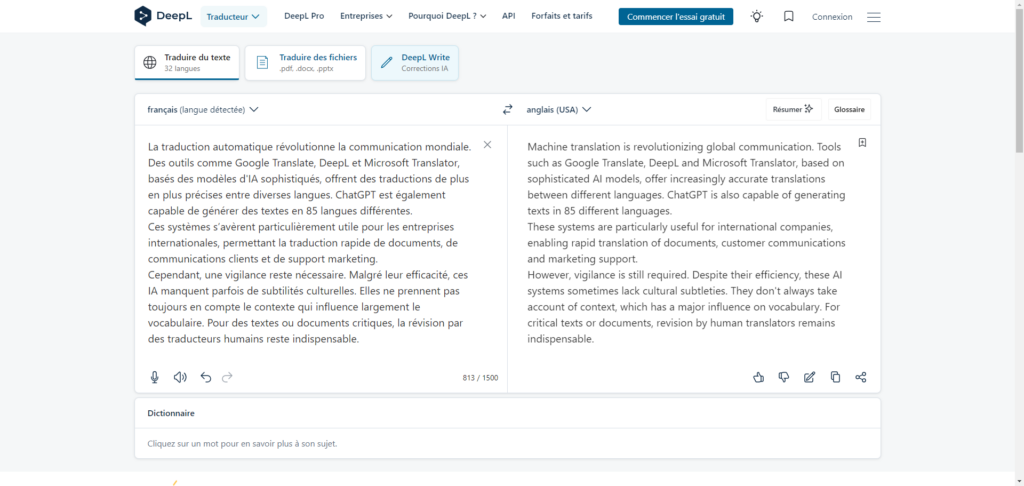

Traduction de texte ou document

La traduction automatique révolutionne la communication mondiale. Des outils comme Google Translate, DeepL et Microsoft Translator, basés des modèles d’IA sophistiqués, offrent des traductions de plus en plus précises entre diverses langues. ChatGPT est également capable de générer des textes en 85 langues différentes.

Ces systèmes s’avèrent particulièrement utile pour les entreprises internationales, permettant la traduction rapide de documents, de communications clients et de support marketing.

Cependant, une vigilance reste nécessaire. Malgré leur efficacité, ces IA manquent parfois de subtilités culturelles. Elles ne prennent pas toujours en compte le contexte qui influence largement le vocabulaire. Pour des textes ou documents critiques, la révision par des traducteurs humains reste indispensable.

Si vous préférez faire appel à un traducteur freelance, déposez un projet gratuitement sur notre plateforme afin d’échanger avec des traducteurs humains qui sauront personnaliser les traductions et avoir une vision d’ensemble de votre projet.

Utiliser l’IA en entreprise pour résoudre des problèmes ou bugs

L’intelligence artificielle peut jouer un rôle sur la manière dont vous surveillez et maintenez les performances des sites web. Des outils spécialisés tels que Sentry, Rollbar ou Datadog APM utilisent des techniques avancées pour améliorer ce processus :

- Détection rapide des problèmes : L’IA peut identifier des anomalies telles que des liens brisés, les erreurs de chargement des pages et d’autres interruptions qui affectent l’expérience utilisateur. Ces systèmes scannent le site en continu, puis alertent les équipes dès qu’un problème est détecté, ce qui permet une réponse rapide avant que les utilisateurs ne soient impactés.

- Analyse approfondie des logs d’erreur : Ces outils utilisent des algorithmes pour collecter, trier et filtrer les logs de sites web, afin d’identifier les causes précises des dysfonctionnements, comme les ralentissements dus à des scripts ou à une surcharge du serveur.

- Proposition de solutions : Non seulement l’IA détecte les problèmes, mais elle peut aussi recommander des actions pour les résoudre : suggestions de modifications de code, ajustements de configuration, mises à jour de l’infrastructure…

Si l’intelligence artificielle est un outil puissant pour surveiller et analyser les performances des sites web, elle n’est pas sans failles. Comme recommandé précédemment, complétez toujours l’IA avec des tests manuels et automatisés pour couvrir toutes les facettes de l’expérience utilisateur.

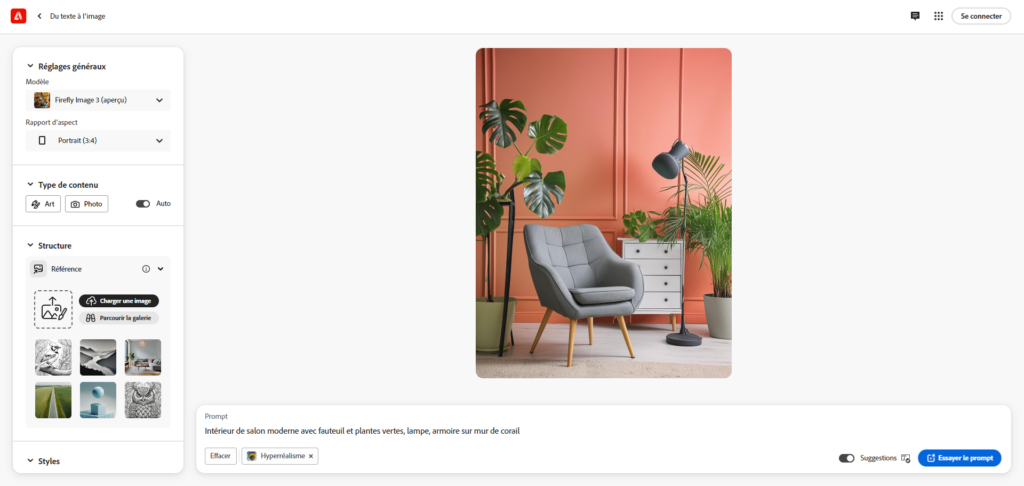

Générer des visuels

Avec des IA génératives telles que DALL-E, Midjourney, Adobe Firefly ou encore Bing Image Creator, les utilisateurs créent des images, vidéos et animations à partir de descriptions textuelles.

Pour votre entreprise, ces outils s’imposent comme des aides précieuses pour produire rapidement et facilement des contenus visuels pour votre blog ou vos réseaux sociaux, mais aussi pour trouver des idées créatives pour vos campagnes marketing.

Néanmoins, les générateurs d’image par intelligence artificielle sont parfois difficiles à piloter. Il est essentiel de maîtriser l’art du prompt pour obtenir un visuel qui correspond parfaitement à votre charte graphique et votre image de marque. Une supervision humaine reste nécessaire pour intégrer votre logo, vos couleurs et s’assurer qu’il n’y a pas d’éléments inappropriés, que l’IA pourrait créer sans le vouloir.

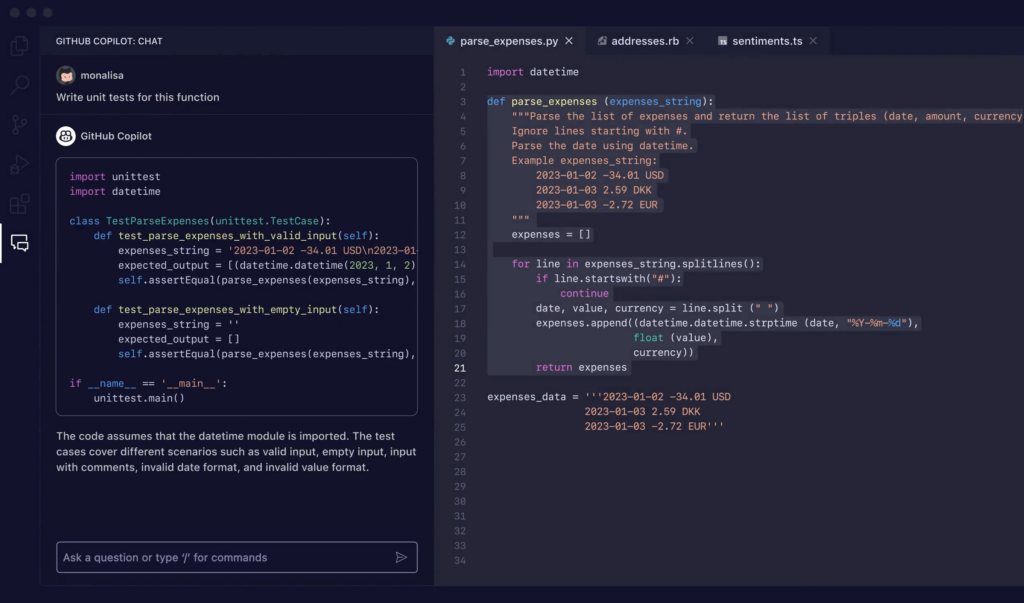

Assistance au développement

L’intelligence artificielle redéfinit le développement logiciel, boostant la productivité des programmeurs. Comment ? Voici quelques exemples :

- Génération de code : GitHub Copilot peut suggérer des lignes de code ou des blocs entiers en fonction du contexte du projet. Les développeurs peuvent construire rapidement des applications sans devoir écrire chaque ligne manuellement.

- Analyse de code : Amazon CodeGuru révise le code pour identifier les pratiques inefficaces et coûteuses, puis propose des alternatives pour optimiser les ressources et améliorer les performances.

- Détection de bugs : Des outils comme SonarQube utilisent l’IA pour analyser le code source et détecter les vulnérabilités ou les bugs. Un processus utile pour prévenir les problèmes avant la mise en production.

- Prédiction des problèmes de code : Des systèmes intégrés dans des IDE comme IntelliJ IDEA ou Visual Studio utilisent l’IA pour prédire les erreurs que les développeurs pourraient commettre en tapant du code, offrant des corrections en temps réel.

Comme toujours, ces IA doivent être considérées comme des guides qui facilitent le développement. En aucun cas elles ne peuvent se substituer à l’humain. Les développeurs ont tout intérêt à examiner minutieusement chaque suggestion ou ligne de code générée, pour vérifier leur justesse, leur pertinence et leur sécurité. Cette démarche assure que l’IA ne compromet pas l’intégrité du projet.

Utiliser l’IA en entreprise pour automatiser des tâches répétitives

Saisie de données, gestion des e-mails, traitement des paiements, flux de validation… Ces tâches sont aussi routinières que chronophages. L’intelligence artificielle agit sur ces missions redondantes en les automatisant via des workflows préconfigurés. Une automatisation qui booste la productivité de vos équipes et la compétitivité de votre entreprise. En effet, libérés de ces actions répétitives, les employés consacrent davantage à des activités plus stratégiques.

Attention tout de même à bien tester les workflows et à vérifier régulièrement leur fonctionnement, notamment pour les situations complexes. L’IA reste très binaire et pourrait mal interpréter certaines exceptions ou certains contextes.

Analyse de données

L’intelligence artificielle transforme l’analyse de données grâce à sa capacité à explorer et traiter de grandes quantités d’informations. Des outils comme Tableau Software, IBM Watson Analytics et ChatGPT-4o peuvent extraire des tendances, des prédictions et des insights précieux, depuis des études, documents ou sites internet.

L’IA vous génère des reportings et tableaux de bord, avec des suggestions d’amélioration. Un atout précieux pour vos prises de décisions marketing, commerciales, opérationnelles ou logistiques.

Bien entendu, vos conclusions ne doivent pas dépendre uniquement des résultats fournis par l’IA. Les décideurs doivent comprendre les modèles utilisés par l’IA et appliquer leur propre jugement, en intégrant notamment les considérations sociales et éthiques que la machine n’appréhende pas forcément.

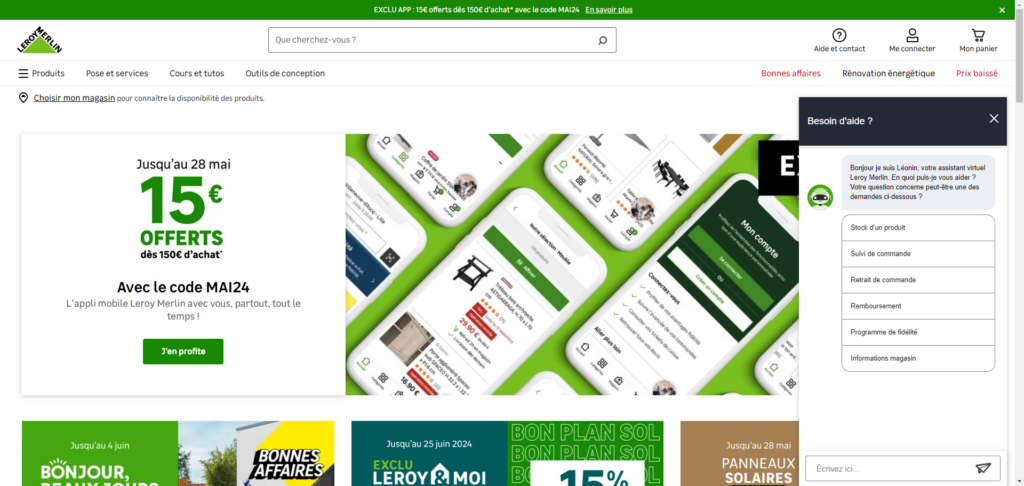

Amélioration du service client

Les chatbots ont déjà bien percé dans l’univers du service client. Ces robots conversationnels dopés à l’IA, accessibles 24/7, améliorent l’expérience des consommateurs en fournissant rapidement des réponses aux questions courantes. Certains bots plus poussés peuvent même personnaliser les interactions en se basant sur l’historique de chaque client.

Les avantages de ce type d’IA pour votre entreprise sont nombreux :

- Réduction des coûts : En automatisant les réponses aux questions fréquentes, les chatbots diminuent le besoin de personnel dédié au service client.

- Amélioration de la satisfaction client : En fournissant des réponses immédiates et pertinentes, les chatbots contribuent à une meilleure satisfaction client.

- Gestion efficace des volumes élevés : L’IA peut gérer simultanément un grand nombre de requêtes, ce qui est particulièrement utile lors de pics d’activité.

- Optimisation du service client : Les agents du SAV dégagent du temps pour le traitement des réclamations personnalisées, la gestion de cas clients spécifiques, l’amélioration des relations client, la création d’initiatives proactives de fidélisation… Des missions à forte valeur ajoutée pour votre entreprise.

A ne pas oublier : maintenir un équilibre entre l’assistance IA et l’intervention humaine reste essentiel pour la satisfaction et la confiance des clients !

Notre dernier conseil pour utiliser l’IA en entreprise

L’adoption de l’intelligence artificielle transforme le quotidien des entreprises et font gagner un temps précieux aux équipes. Toutefois, pour maximiser les bénéfices de l’IA sans en subir les inconvénients, une supervision humaine attentive reste indispensable. Les outils d’IA offrent des solutions puissantes mais requièrent un ajustement et une personnalisation continus.

Si vous avez besoin de déléguer certaines tâches, comptez sur nos freelances pour vous accompagner. Postez gratuitement une annonce sur Codeur.com pour obtenir une expertise humaine et booster la compétitivité de votre entreprise !